Some Known Details About Matthew J. Previte Cpa Pc

Some Known Details About Matthew J. Previte Cpa Pc

Blog Article

7 Simple Techniques For Matthew J. Previte Cpa Pc

Table of ContentsMatthew J. Previte Cpa Pc Fundamentals ExplainedThe Single Strategy To Use For Matthew J. Previte Cpa PcMatthew J. Previte Cpa Pc for BeginnersThe Best Guide To Matthew J. Previte Cpa Pc

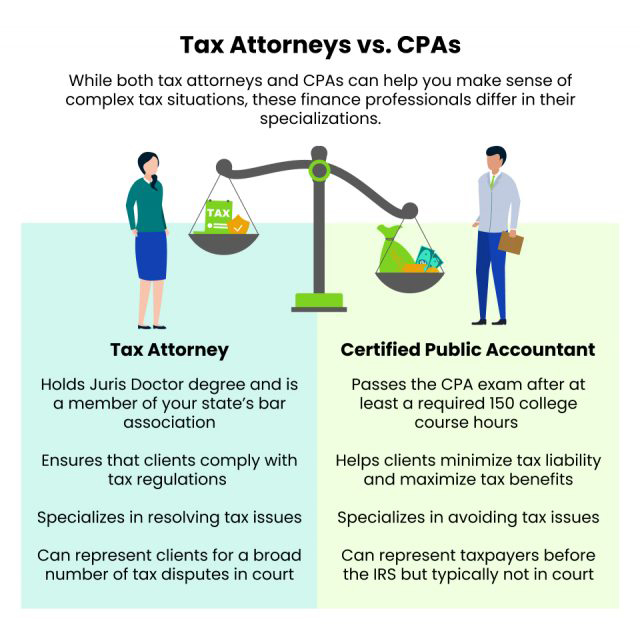

The Internal Income Solution (IRS) is one of our nation's most effective government agencies, and when you think about the firm's function, that makes a great deal of feeling (https://taxproblemsrus1.bandcamp.com/album/matthew-j-previte-cpa-pc). The Internal revenue service supervises the nation's tax laws and collects what taxpayers owe. All these funds go in the direction of keeping the federal government runningAttempting to overturn the firm's authority can land you in significant monetary and lawful difficulty. In this situation, a tax lawyer can be essential to helping you navigate your tax problems. A tax obligation attorney can stand between you and the IRS. They can serve as your lawful supporter when it comes to tax problems, tax inquiries, and future tax obligation problems.

A tax obligation lawyer is a lawful professional who has thoroughly examined the interpretation and application of tax regulations. These sorts of tax obligation specialists are highly experienced and have a strong understanding of tax policies at the federal and state levels. Tax obligation attorneys have finished from regulation institution, got a license to exercise regulation, and passed the state bar.

Facts About Matthew J. Previte Cpa Pc Uncovered

Get even more details on specifically how your tax lawyer could aid in different scenarios below. The top situation that calls for using a tax obligation lawyer is when you might encounter legal effects as an outcome of your present tax obligation situation - IRS Levies in Framingham, Massachusetts. When your tax obligations are substantially overdue, the internal revenue service has several ways to punish you

If you're experiencing a tax obligation conflict with the IRS, after that it's recommended you employ a tax obligation lawyer as soon as feasible. If you're merely looking for strong and trustworthy tax obligation guidance, then a tax attorney is a great resource to take advantage of.

Per Internal Profits Code Area 7421(b)( 2 ), the Internal revenue service needs to quit speaking to a taxpayer if they say they would prefer to consult with a tax obligation lawyer, a CERTIFIED PUBLIC ACCOUNTANT, or an enlisted agent concerning their tax obligation situation.

The Ultimate Guide To Matthew J. Previte Cpa Pc

You must officially file a power of lawyer, or else referred to as IRS Type 2848 (IRS Seizures in Framingham, Massachusetts). Type 2848 gives the specific called in the kind (your tax lawyer) the lawful authority to obtain your tax obligation information for the tax obligation years on your type and to represent you in front of the internal revenue service

Remember that these kinds do not discharge the taxpayer from legal responsibility. You will still be totally liable for your tax scenario. It is possible, yet not an assurance, that your tax lawyer might be able to decrease the total tax debt you owe to the internal revenue service. The major method they 'd have the ability to secure a lowered costs for you would certainly be to take advantage of existing internal revenue service tax obligation debt mercy programs such as: Your attorney will certainly not have any even more negotiating power than you as an individual taxpayer, but they do have the benefit of learning about the different programs the internal revenue service uses to give relief to taxpayers.

For example, if the law of limitations on a few of your financial debt has already passed, then your legal representative may be able to obtain the IRS to cease collection initiatives by explaining that they have no legal basis to seek the funds any longer. Federal Tax Liens in Framingham, Massachusetts. Since you have a better understanding of what a tax obligation attorney can do for you, it depends on you to decide if you think you need to hire a lawyer or otherwise

Our Matthew J. Previte Cpa Pc PDFs

These kinds do not absolve the taxpayer from legal obligation. You will certainly still be completely responsible for your tax scenario. It click here for more info is possible, yet not an assurance, that your tax obligation attorney might be able to reduce the general tax obligation financial debt you owe to the internal revenue service. The major method they 'd be able to safeguard a lowered costs for you would certainly be to capitalize on existing internal revenue service tax obligation financial debt mercy programs such as: Your attorney will not have any kind of more negotiating power than you as a specific taxpayer, but they do have the benefit of learning about the different programs the IRS makes use of to offer alleviation to taxpayers.

As an example, if the law of constraints on several of your financial obligation has actually already passed, after that your legal representative may have the ability to get the internal revenue service to stop collection initiatives by explaining that they have no lawful basis to choose the funds anymore. Now that you have a much better understanding of what a tax obligation attorney can do for you, it's up to you to determine if you think you require to work with a lawyer or not.

Report this page